One would have to try very hard to ignore the media frenzy surrounding home values in the southland, but does their argument that “demand is returning to the housing market” really hold any truth? Or are we as homeowners, only hearing what we want to hear!

For most homeowners their primary residence represents one of their largest investments, and over the past few years most of us have had to sit idly by as our property’s value fell off a cliff with the economy; however there are many indications currently being publicized that would lead one to believe the “fall” is over.

Regardless of whether you watch CNBC or FoxNews, the same story is being told: Buyer demand has returned to the housing market, and as a result home prices have found a bottom. While I know that I should be saying Hallelujah and dancing a jig in the street, I can’t help but feel somewhat skeptical. Therefore, in an effort to ease our collectively troubled minds, I have decided to do some digging of my own.

When doing research I often find that phrasing my objective as a question allows me to more clearly organize my thoughts, and in this case I asked myself: Is buyer demand returning to the market?

Having identified our objective I then moved on to what I already knew, and given that we do run one of the highest grossing real estate firms in Glendale, I have a good deal of firsthand experience. For example I know that every time we list a property we get at least 10 offers on it, which is up from last year. In fact if I were to base my research solely on what I see with our listings I would wrap it up here and say that buyers demand has in fact returned. Yet I insisted on digging deeper and truly finding an objective answer to our question.

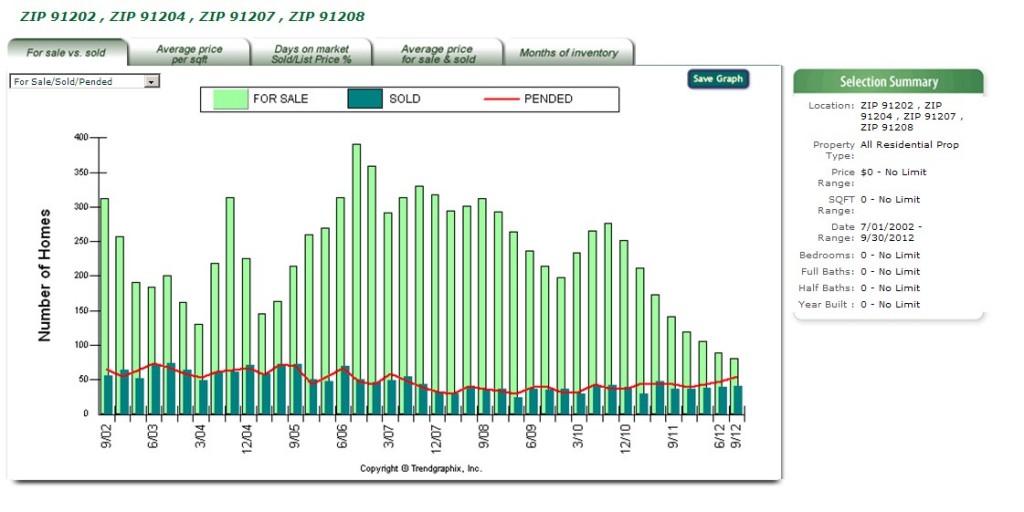

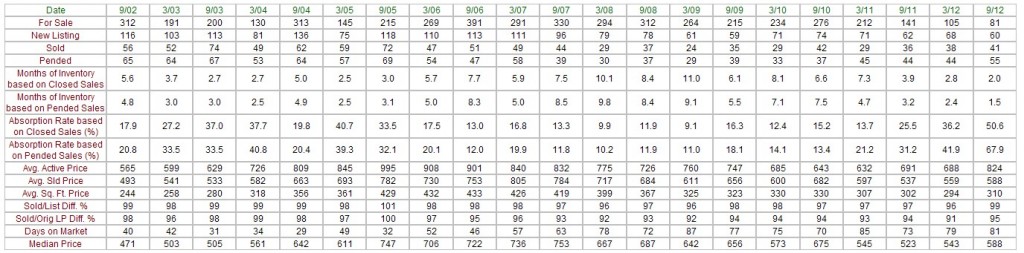

I decided to pull data on 91208, 91207, 91204, and 91202, for the past 10 years of sales, and what I found was very interesting.

I found that over the past 10 years we have never had fewer properties on the market (just 81 in the month of September). I also found that based on the number of sold properties (41 in the month of September) we are at a 10 year low, with the market inventory only having the capacity to hold us over for 2 months! Essentially, if no new listings came on market and sales remained the same, the market would be empty in just two months!

Looking at that information we could jump to the conclusion that all the available real estate is being bought up, and that buyer demand has returned. However, if you take a look at the number of properties sold during September and compare it to the average number of properties sold per month for the past 10 years, you will find that the number of sales per month really hasn’t increased. This is a strong indication that what we could be experiencing is not really an increase in buyer demand, but a decrease in the listing supply!

The only issue with accepting that as the full and final answer to our question is this pesky little metric called Days-On-Market, or DOM. DOM signifies the average number of days a property sits on the market before the sale closes, and unfortunately in September we were at an average of 81 days on market. This is about 6 days shy of the 10 year high.

So how could it be that while we are at a 10 year low in supply, and demand has remained unchanged, it is taking so long to close sales?

The answer may be simpler than we think: REOs. Given the amount of foreclosures in the past couple years, there is a backlog of Bank Real Estate Owned properties (aka REOs). These properties are traditionally poorly marketed and under maintained, resulting in extreme amounts of time on market and low sales prices.

So what we may be seeing is the effect of outliers on an average. For example if you have a handful of REO properties that have been sitting on the market for 365 days (which commonly happens) it will shift a reasonable DOM figure to something that is unreasonable. Thus we would see an increase in DOM but not an increase in inventory.

Ultimately, by combining all of these “discoveries”, we arrive at the answer to our question: Has buyer demand returned to the market? Not to the overall market.

What I mean is that buyer demand has returned to certain parts of the market, as is evidenced by the abundance of offers we receive on our listing; however there are still many segments of the market that are depressed and the latency within those markets is skewing the data that we have on hand.

All of this being said the modest increase in buyer demand coupled with the extraordinary decrease in inventory creates the perfect storm, or as economists call it: scarcity.

As the remaining distressed properties work themselves out of the market we would naturally expect the metrics to return to where they should be in a scarce environment: low inventory, high demand, and low days on market.

The only problem with waiting for that moment to arrive is that it is never going to happen. Why? Well, simply because people aren’t stupid. As soon as the days on market start to fall, and homeowners begin to realize that the power has shifted back to them, the inventory will gradually begin to increase as they will begin to list their property for sale. This cycle of decrease in supply until demand increases and then an increase in supply until demand decreases, is the reason why we will never see a perfectly scarce environment.

So, if you are still with me, what is one to do with this profound understanding of the market we are currently in? Well, frankly I would take advantage of the smoke screen that is being provided by the high days on market, and list my property while the inventory is tight.

—–

Below is the data table that played a major part in the formation of my conclusion.

Feel free to leave your feedback below.

-JJM

John is the Vice President here at JohnHart, and as such is responsible for managing and directing the firm towards obtaining its ultimate goals.

He is also one of our main contributors on the Blog. (please see his profile page on the main site for more information.)