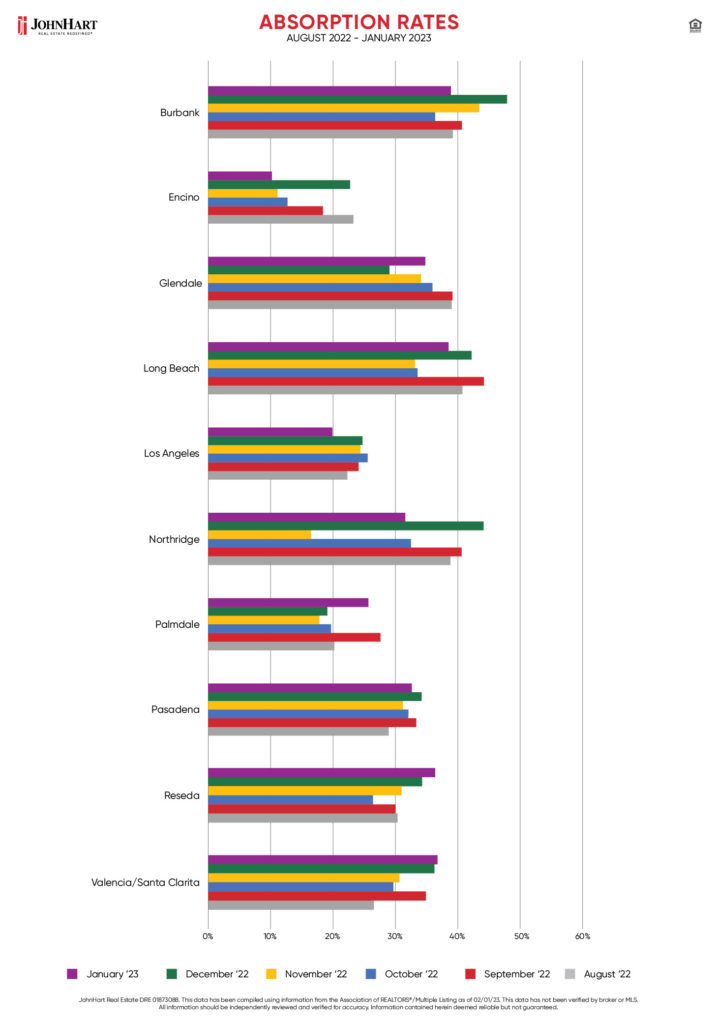

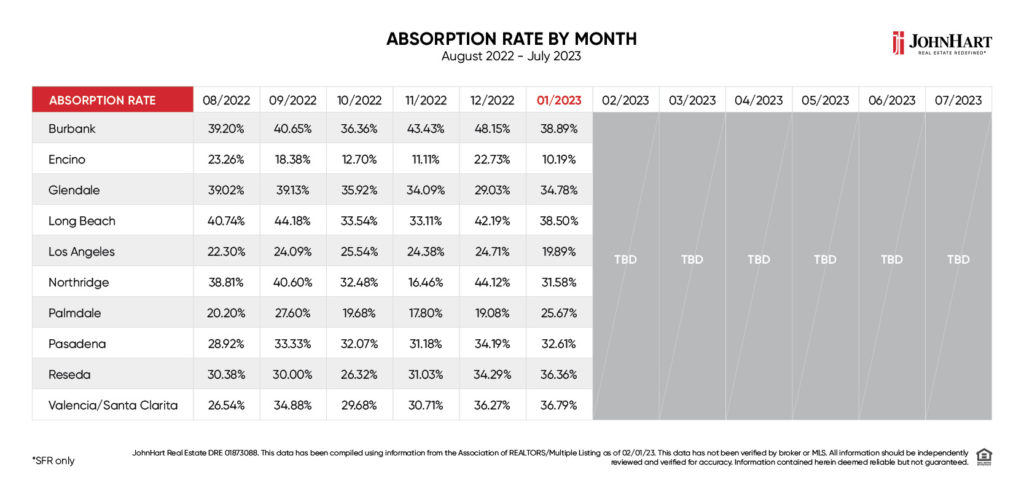

At first glance, January seems like it was a big month for the Los Angeles housing market… at least in some neighborhoods. The absorption rate had massive drops toward a buyer’s market in Encino and Northridge. That’s not to detract from decent bumps further into seller’s market territory in Burbank and Palmdale. But while these shifts may seem radical, if we take a step back, we see a lot of these bigger markets are just a few percentage points from where they were back in August when we started releasing our statistics. And since transactions can easily take a few months, that overall number may be a better indicator of the standing of your neighborhood’s housing market.

Absorption Rates – January 2023

- Burbank – 39%

- Encino – 10%

- Glendale – 35%

- Long Beach – 39%

- Los Angeles – 20%

- Northridge – 32%

- Palmdale – 26%

- Pasadena – 33%

- Reseda – 36%

- Valencia/Santa Clarita – 37%

First, a quick rundown of how we get these numbers. Skip past the formula if you’ve read our analysis before!

- Our data only considers single family homes. We feel this is a better representation of our clients’ interests.

- In the U.S., an absorption rate of 20% or higher is indicative of a seller’s market. This means conditions favor the seller. Absorption rates of 15% or below are considered a buyer’s market, thus favoring buyers. However, the Los Angeles housing market is very different from the national average. Therefore, we take these indicators with a grain of salt.

- We utilize a universally accepted absorption rate formula, factoring in our own original data. That formula is:

Encino Drops Back to the Buyer’s Market

Now, let’s dive into the data. For those who have been keeping up with our monthly absorption rate analysis, you know that the Greater Los Angeles housing market as a whole has been entrenched in a seller’s market. The only neighborhood that really fell into a nationally accepted buyers’ favor was Encino. And that just happened in October when the valley community dipped down to a 13% absorption rate. Therefore, despite its December surge to 23%, it may not be that big of a surprise that Encino dove back into the buyer’s market in January.

Encino is now at a 10% absorption rate. And, yes, that’s a low we haven’t seen since we started publicly tracking absorption rates last August. Back then, Encino had a 24% absorption rate and has been (almost) steadily dropping ever since. So, if you’re looking to buy, you might want to start your search in Encino.

Northridge Drops Back Toward the Buyer’s Market… or Does It?

Now, let’s look at that significant drop in Northridge. The drop in Northridge comes after the city’s rebound last month from its lowest absorption rate in November when it hovered just above the buyer’s market at 16%. They’ve gone from December’s 44% absorption rate down to a 32% absorption rate. Despite the second largest drop of the month, they’re still firmly entrenched in a seller’s market.

But what’s interesting is that, back in August when we first started publicly sharing our data, Northridge was at 39%. And though the area’s absorption rate has done a fair amount of jumping around, the six-month average is 33%. So, what looks dramatic at first glance is actually Northridge centering to its average.

Burbank: Surging or Stabilizing?

Surges were less dramatic this month, but there were still a couple worth noting. The biggest increase happened in Burbank where the absorption rate leapt further into the seller’s market by 9% for a 39% absorption rate. But considering the six-month average for Burbank is a 41% absorption rate, this surge also seems more like stabilization.

Palmdale: Erratic But Not Quite Unpredictable

The second highest surge happened further north in Palmdale. The area’s absorption rate increased by 7% for a 26% absorption rate. This one’s a bit more of an outlier, putting it a small bump above its six-month average of 22%. Does this mean it’s going to drop back next month? The desert neighborhood seems to maintain a 10% range, with 26% at the upper end. Therefore, if it does surge again next month, we doubt it will be very dramatic.

The More Things Change, the More They Stay the Same in the Los Angeles Housing Market

This brings us to the overall picture that we’re seeing after six months of publicly sharing our data. Even though we’re seeing plenty of periodic drops and surges, they rarely deviate much from collected averages. This lends a great deal to a theory posited by our CEO, founder, and principal broker Harout Keuroghlian. He believes that we’re not going to see much change in the Los Angeles housing market for some time.

And though drops like Encino’s and surges like Burbank’s seem to argue against this theory, we see a different picture when we step back. The Greater Los Angeles area’s housing markets aren’t changing much on average. That’s why it might be a good idea to start moving forward with your plans to buy or sell. Otherwise, you may be batting down the hatches for a waiting game that will feel interminable. Especially if you’re expecting homes to drop back to 2008 prices.

Why the Los Angeles Housing Market Isn’t Actually Changing Much

Why is the Los Angeles housing market so locked into this level? Harout gave a variety of potential factors that are likely at play. We’ll be examining these further in a future blog, but they include:

- Trillions of dollars in readily available equity.

- Low interest rates.

- High rents.

- The safety net of a gig economy.

- ADU/JDU supplementation.

And that’s just to name a few.

Last month, we ended by saying “A lot can happen in a month or two.” And when you really examine the data closely, that’s true. But when you look at the big picture, it might be more accurate to say “Things haven’t changed that much in six months.”

If you’re waiting for the next big thing, we hope you’re really comfortable in your current situation. But if things aren’t perfect, it may be worth trying your chances in the market. A talented agent can help you hedge your bets (hint hint). In the meantime, we’re going to keep running our monthly absorption rate analysis and sharing the results. The Los Angeles housing market may be a sleeping beast, but it’s a beast nonetheless. And we’d rather keep an eye on it!