Another lockdown looms in the distance but on the horizon hangs the hope that a vaccine may come first. Could this be the reason why the housing market has taken two distinct directions as of late? This and more after the commercial break.

And we’re back. Today we will evaluate the housing market, but rather than inspecting it as a whole, we’re going to break it down into the Single Family Residence Market (traditional houses) and the Condominium/Townhouse Market. The reason for the separation? Since the pandemic really took hold in March 2020 we’ve started to see the two markets move a little differently.

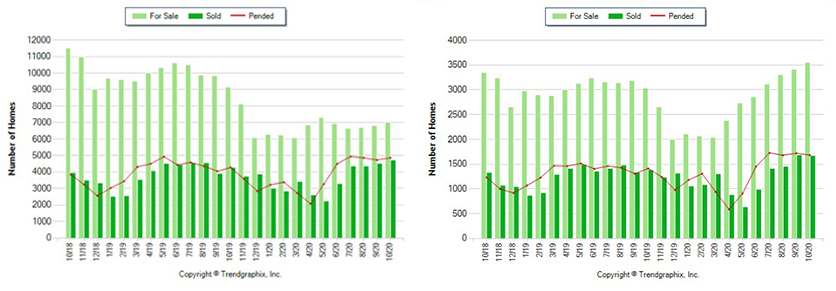

It’s easiest to see the separation visually, take a look at the two graphs below:

On the left we have SFRs and on the right, we have Condos, both over the same two-year period. If you look closely you will notice that both follow a similar shape in the first two-thirds of the graph. However, while they both illustrate an uptick in For Sale inventory (light green) in March 2020, as is expected seasonally, around May the two markets stopped correlating positively.

So which market was it? Did the SFR market fail to launch or is the condo market pulling away? Let’s look at the numbers and see if we can draw a conclusion.

In the SFR market, we’re seeing that the median sold price for LA county is $825,000, up from $680,000 a year earlier. The median sold price for Condos/Townhouses is $550,000, up from $520,000 last year. Months of Inventory is down to 1.5 for SFRs (from 2.1 YoY) and for Condos, we’re looking at 2.1 versus 2 a year earlier. For Sale inventory for SFRs is up 3.1% from the prior month, however, we are still down 23.1% year over year! Condo inventory is up 4% month over month and up 17.1% year over year.

This is an interesting situation because what we are actually seeing is both markets moving unpredictably and out of pattern. Cyclically we expect to see a pinch in inventory in Winter and by March we see the inventory begin to pick back up. This occurred in the Single Family Residence market, but in May we saw an inventory crash as people apparently held on to their properties. We are starting to see some minor signs of inventory beginning to come back – perhaps somehow influenced by the hope that a vaccine may be close. In the Condo market, we saw the exact opposite. In May the market took off! Inventory has been pouring onto the market disproportionally when compared to previous years and it hasn’t slowed down – perhaps influenced by people working remotely and wanting to move out of the city, or out of concern about proximity to strangers, or even rising crime.

What does this mean for the market? If you own a house, congratulations, the pinch in inventory has driven up the price of your property substantially in the last 12 months. If you own a condo, you might want to be a little concerned. All of that built-up inventory will start to push down prices as listings become stale and price reductions begin. It is also important to note that we saw a decrease of 1% in sold inventory month over month for condos and townhouses – which leads me to believe that in addition to excess supply we’re now looking at less demand as well.

The bright side? At the end of the day, this is LA. Even if it appears a Covid-fueled correction is coming for the condo market, it likely won’t be drastic and the bounce back will come as soon as the inventory clears out or demand returns.

Stay tuned for next month’s Monthly Market Update to see how the numbers progress!

John is the Vice President here at JohnHart, and as such is responsible for managing and directing the firm towards obtaining its ultimate goals.

He is also one of our main contributors on the Blog. (please see his profile page on the main site for more information.)