Maybe you just found your dream home. Or maybe you just realized that the living situation that’s worked for you in the past isn’t cutting it today. It’s all good until that dreaded moment when you seek home loan pre approval… only to get denied. Where can you go from here? Ten times out of ten, we’d tell you to talk with a compassionate real estate agent. You know, the kind that stay invested in their client’s well-being, even outside the transaction process. Sounds like a JohnHart agent! But if you like to look before you leap, we’ve got you covered. Here’s what you can expect from the home loan pre approval process.

Home Loan Denial Has a Silver Lining

Those who have applied for loans for homes and been summarily denied aren’t exactly joining an exclusive club. It can happen to the best of us. The most important thing to recognize in this situation? That it’s not the end of the world. It’s not even the end of your quest for home ownership!

But the second most important thing to recognize is that a loan denial gives you much-needed information. Because within 30 days of the denial, your lender is legally obligated to inform you why they chose to deny you.

In most cases, a denial is issued for one of the following reasons:

- Poor credit

- Little to no credit

- Insufficient income

Once you know why you were denied, you can begin working to correct the issue. If you have a compassionate agent (*cough* like a JohnHart agent *cough*), they might even be willing to strategize with you.

What is a Home Loan Pre Approval?

Here at JohnHart, we’re pretty big into home loan pre approval. Unfamiliar? A pre approval questionnaire helps you determine a feasible mortgage amount for your current situation. In most cases, a pre approval will be processed online or face-to-face with your loan officer. But the process is so simple that you can also find self-service options!

Consider home loan pre approval to be a test run for a home loan application. It works by assessing information you provide such as your credit score, your current income, and the fun part… a hypothetical home. And when the dust settles, a comprehensive home loan pre approval will tell you:

- An estimate on your monthly housing payment

- An estimate on how much you can expect to pay for a mortgage

- The most expensive home you can afford

- Minimum downpayment

- The closing cost for your mortgage

But most importantly, a pre-approval can help speed up the loan approval process. Now that we’ve sold you on the power of pre-approval, you’re probably wondering how to get one for yourself. Fortunately, it’s a rather simple process.

What to Expect When Pursuing Home Loan Pre Approval

In most cases, it’s best to get your home loan pre approval started well in advance of seeking any loans for homes. We’re talking a solid year in advance. That being said, everything happens when it happens, so do what works for you.

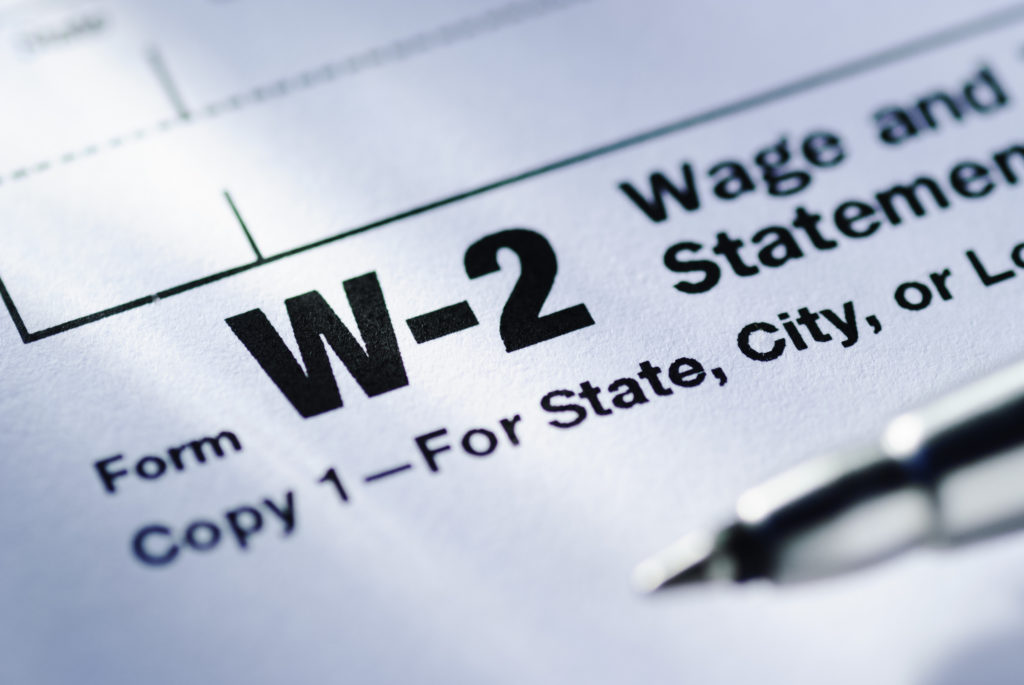

A loan officer will need supporting documents to back up the information provided in your pre approval questionnaire. Be prepared to provide:

- Bank account statements

- Student loan information

- Pay stubs

- Tax returns

- W-2 forms

Ultimately, it will fall on you to decide what you’re comfortable paying for a home. It’s a figure that you should also have handy when filling out a home loan pre approval. Just be careful. When you come face-to-face with your lender, they may offer a loan that exceeds your monthly budget. And since this is your dream of homeownership, it could be tempting to take it. Don’t fall into this rut, or your dream will quickly become a long-term nightmare.

Applying for a Loan Pre Approval

Lending agencies tend to have their own ways of doing things. Therefore, we went straight to the source: Mike Pandazos of Golden Coast Finance. He was happy to break down his procedure for us.

Mike typically kicks things off with a quick phone interview that can run anywhere from five to 15 minutes. At the client’s preference, he can also conduct this pre-interview by text or email. From there, he’ll either schedule a face-to-face interview or, more commonly, send the client a link for online application.

Once the application has been submitted, the client can then upload the supporting documentation we mentioned above. Typically, the process only takes one to two business days. Once received, the home loan pre approval is valid for 90 days, owing to the credit report expiration.

Will Pre Approval Application Hurt Your Credit?

Some applicants are concerned about seeking home loan pre approval out of fear that it will reduce their credit score. In a way, they’re correct. But don’t let that discourage you from seeking pre approval. The drop in credit score is as negligible as it is temporary.You’re also granted a 45-day window to keep shopping for your pre approval without fear of accruing multiple credit score drops. So shop with confidence!

Don’t Confuse Pre Approval with Pre Qualification

It can be easy to confuse a home loan pre approval with a pre qualification. But pre-qualifications aren’t supported by a lender. Therefore, they lack the potency of a pre approval. When a seller is looking for reliable backing in a buyer, they’ll commonly look for a home loan pre approval since it’s reinforced with lender approval.

How the Right Agent Can Help Your Home Loan Pre Approval

So, if you can fill a home loan pre approval out yourself, where does an agent come into play? You can make things a lot easier on yourself by finding an agent who understands the full spectrum of a transaction.

The agents at JohnHart enjoy an added benefit of having our own in-house finance and escrow companies. These kinds of relationships add a further depth of understanding that can begin well outside the standard parameters of a transaction. And, as you can imagine, agents with strong relationships in the financial sector can be especially helpful during the financing process.

Ready to take your first steps in getting your home loan pre approval? Then reach out to one of our agents who can help guide you through the process!

With a brand that says as much as JohnHart’s, Senior Copywriter Seth Styles never finds himself at a loss for words. Responsible for maintaining the voice of the company, he spends each day drafting marketing materials, blogs, bios, and agent resources that speak from the company’s collective mind and Hart… errr, heart.

Having spent over a decade in creative roles across a variety of industries, Seth brings with him vast experience in SEO practices, digital marketing, and all manner of professional writing with particular strength in blogging, content creation, and brand building. Gratitude, passion, and sincerity remain core tenets of his unwavering work ethic. The landscape of the industry changes daily, paralleling JohnHart’s efforts to {re}define real estate, but Seth works to maintain the company’s consistent message while offering both agents and clients a new echelon of service.

When not preserving the JohnHart essence in stirring copy, Seth puts his efforts into writing and illustrating an ongoing series entitled The Death of Romance. In addition, he adores spending quality time with his girlfriend and Romeo (his long-haired chihuahua mix), watching ‘70s and ‘80s horror movies, and reading (with a particular penchant for Victorian horror novels and authors Yukio Mishima and Bret Easton Ellis). He also occasionally records music as the vocalist and songwriter for his glam rock band, Peppermint Pumpkin.