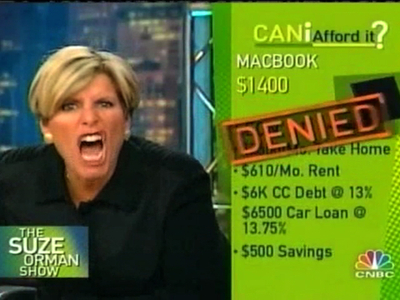

Suze Orman urges us all to get real about harboring the idea that equity will return to our underwater property anytime soon !

According to CBS 13(Sacremento) more than half of the homeowners in three of the largest counties in California (Sacremento, San Joaquin, and Stanislaus) are upside down on their mortgages. Meaning that their property is now worth less than what they currently owe on it. As a result they are faced with a very difficult decision: Keep making my mortgage payment, or walk away?

Don’t be fooled this is not an area specific phenomenon, but rather a microcosm of what is happening to large portion of American in many states.

So homeowners are faced with a dilemma, “do I do the ethical thing and continue to make the payments I promised to make, or do I do the responsible thing and get out of the bad debt that I am in?” and is it even correct to call making payments on an underwater property ethical? Or is it more ethically correct to protect your family and loved ones from a bank-imposed-hardship? After all ethics is an argument about right and wrong, not legal or illegal…

Well according to financial expert Suze Orman, “If you own a home that is 50% underwater, 70% underwater, it will never ever, ever come back you where you purchased it.”

Going even further in her book, The Money Class, Orman says “Do the calculations everybody. How much is it costing you to actually stay in that house? How many years will it take for you to pay more than that house is worth? If it’s 3 years, 4 years, 5 years; are you kidding me? That’s a house you really need to say bye bye. It’s not worth the money.”

Orman goes on to suggest that homeowners should try to get the bank to modify their loans; however given that lenders are not only decreasing the number of modifications they give out, they are also refusing to make trial modification plans permanent, I think she would agree that loan modification is no longer a relevant or realistic option.

So what is the American homeowner supposed to do? Continue to throw good money after bad, and sink their savings (which most don’t even have) in to bad investment? Sure they could do the pious thing, and be a martyr for martyrdom’s sake, or they could get help.

If keeping the property is all that matters to them, then the best option is probably Bankruptcy (aka BK). By filing for BK they can keep the property get rid of some excessive bills and debts they may have, and maybe even strip off a lien entirely, but more than likely the monthly mortgage payment is going to go up. Why? Simply because BK (where the property is retained) is designed as a giant repayment program, and the debtor’s arrears will be spread of five years to allow them to catch up and get back on track; but each month they must make your mortgage payment and the arrears payment (missed payments +interest/60 months). So this option really is only a good idea to those who can afford to pay their mortgage, and a little extra, but for some reason or another fell behind at one point.

What if the homeowner had a pay decrease, lost their job, or God forbid has one of those nasty negative amortization mortgages (aka pay option adjustable rate mortgage), and can’t afford the mortgage payment all together. What then?

Well “then” Orman states “you need to either do a short sale. If they will not allow a short sale, then do a deed in lieu of foreclosure. If they won’t do that then walk away. It’s just how it is.”

So following this logic, the last resort would be to walk away, and for obvious reasons. While it may seem like the easiest option, it is going to follow that person for a longggg time. Their credit cards will most likely be revoked, their ability to rent anything (including a place to live) will be greatly diminished, and they will have directly contributed to the further decline of the housing market and US economy. A government official I spoke with (who wished to remain nameless) said that “with the options available to distressed homeowners, walking away without exhausting them is truly a cowards way out”!!!

Getting back to Orman’s succession of events, the second to last resort would be Deed in lieu of foreclosure, or DIL. Through a DIL, the homeowner reaches an agreement with the bank to vacate property and return the deed/ownership of the property to them. However, coming from someone in the field, trust me this option hardly ever ends with a successful outcome. In fact the banks almost guarantee that it won’t be successful by creating, enacting, and 99% of the time following the policy of not postponing or stopping a foreclosure sale date for the DIL process. They will foreclose and auction off the property right out from under the homeowner, while another department tries to work with them on a DIL.

Finally, we come to the best option available short sale. The benefits of short selling versus these other two options are plentiful, but to sum them up, here are the biggest ones:

- You get to stay in your property while the process is going on.

- Your foreclosure sale date will usually be postponed, allowing even more time in the property.

- You often get relocation assistance in the form of cash (I have seen anywhere from $3k to $33k given out).

- Your credit ends up in better shape than if you walk away.

Now understanding that this is probably the best course of action, Orman urges that if you are thinking of doing a short sale, now is the time. She says that sometimes it takes a year of more for a short sale to go through. She also said that the federal tax break allowing for debt forgiveness resulting from a short sale is set to expire at the end of 2012. To put it plainly, if you short sell your property for $100k less than what you owed on it, and the sale closes on January 1, 2013, you are going to be expected to pay taxes on the $100k you saved through short sale.

Let us return to the question at hand, is it more ethically correct to protect your family and loved ones from a bank-imposed-hardship, than it is to continue making the payments you agreed to make? If you have read this far than I think you would agree with me and Suze Orman, there is an ethical way to get out of your predicament, resulting in a win for everyone: Short sale.

Feel free to contact us with any questions you may have about your options, and I cannot say this enough: choose a listing agent who is experienced and set up to handle short sales. They are intensive and easily screwed up by the traditional real estate agent.

John is the Vice President here at JohnHart, and as such is responsible for managing and directing the firm towards obtaining its ultimate goals.

He is also one of our main contributors on the Blog. (please see his profile page on the main site for more information.)